Whether photographing tarantulas on the hot, desert highway or interviewing cryptocurrency founders on the floor of the New York Stock Exchange, storytelling has taken me down some fascinating roads. As a journalist, editor, and media specialist, my goal is always the same: to bring readers into the heart of the story.

Currently, I serve as a reporter and media specialist for Taos News, the nation’s top-ranked small weekly newspaper, where I cover news, business, and culture—while also driving sales revenue through strategic marketing and outreach and aiding to produce 20+ magazines annually. As a freelance writer and editor, my work spans industries and formats, from real estate and finance to art and lifestyle, with features in Sotheby’s International Realty, Apartment Therapy, CitySignal, and more. Past roles include managing editor for New York German Press, project manager for pandemic response initiatives, and technical writer for tech and aviation clients.

Currently based in Taos, New Mexico.

Millionaires are on the move. The great wealth migration, which paused briefly during the pandemic, hit record levels in 2024 as an estimated 128,000 high-net-worth individuals (HNWIs) migrated to new countries, according to the 2024 Henley Private Wealth Migration Report, an annual publication analyzing the movement of HNWIs and their wealth.

This trend was further backed up by banking giant UBS, which found in its December 2024 Billionaire Ambitions Report that the world’s ultra-wealthy have relocated more frequently since 2020, with 176 having moved from a total population of 2,682—or one in 15.

Although there is no standard legal definition, a HNWI is popularly defined as someone with at least US$1 million in investable assets. Shifts in HNWI demographics are an important barometer of a country’s economic health and political stability, with major outflows often indicating serious underlying issues. A country’s political climate was found to be the primary concern of both buyers and sellers when choosing housing, a 2025 survey of Sotheby’s International Realty agents revealed, followed by interest rates, inflation and tax reform.

With over 135,000 HNWIs projected to migrate in 2025, according to the Henley report, understanding these trends is crucial for investors and real estate professionals seeking to navigate the evolving dynamics of luxury markets while capitalizing on emerging opportunities.

Read more at https://www.luxuryoutlook.com/2025-luxury-outlook-report/migrating-wealth

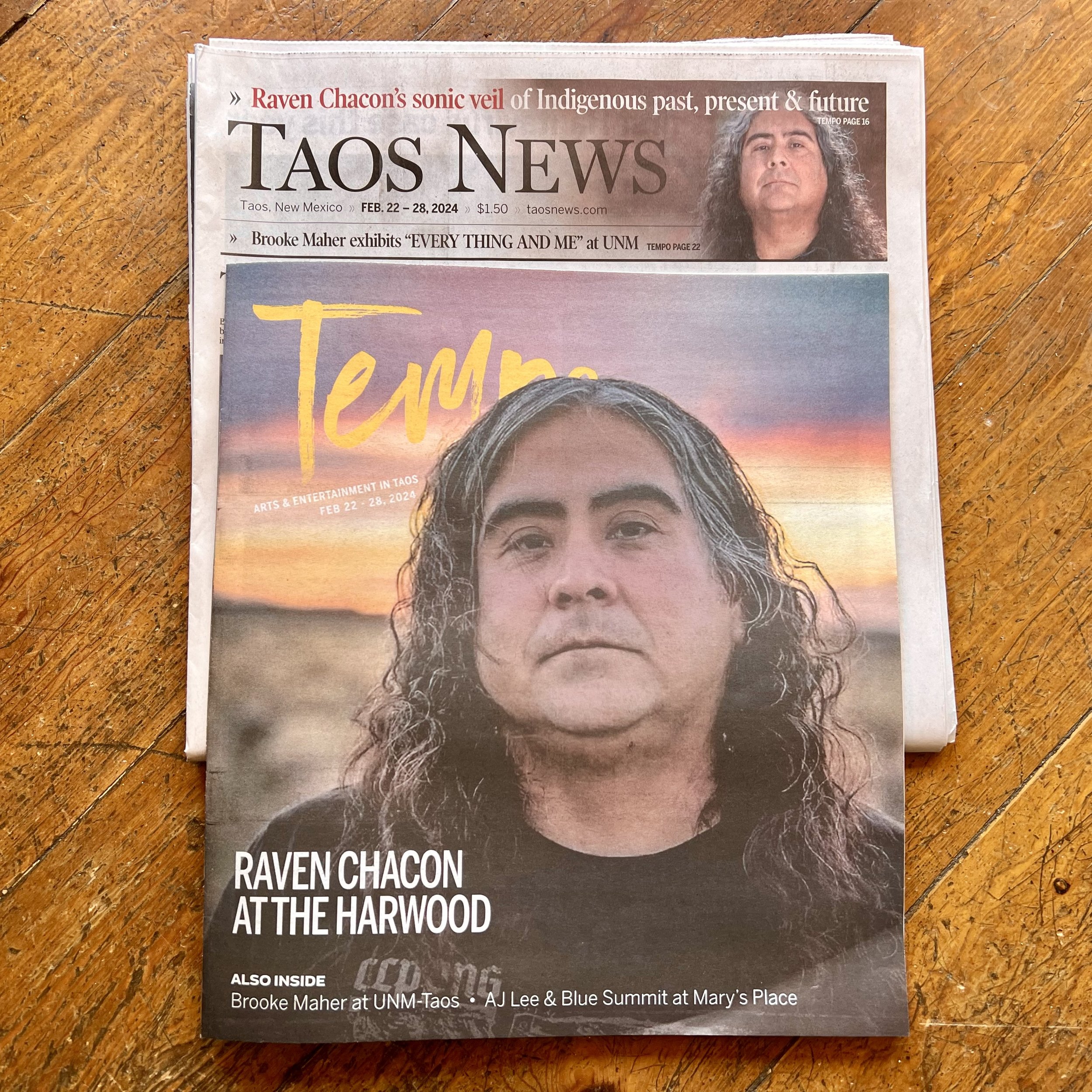

“The much anticipated "Raven Chacon: Three Songs," opening this week at the Harwood Museum of Art, is a meaningful and layered journey of visual, sound and installation art. Through keen sonic vision, Raven Chacon magnifies history, fortitude and life trajectories, weaving a sobering yet ethereal fabric of past, present and future.

A 2023 MacArthur Fellow and 2022 Pulitzer winner from Fort Defiance, Navajo Nation, Chacon is a Diné composer, performer, and installation artist based in Albuquerque. "Raven Chacon: Three Songs" synthesizes three previous works: "Silent Choir" (2016-2017), "For Zitkála-Šá" (2017-2020) and "Three Songs" (2021), shown in totality only once prior at the 2022 Whitney Biennial.

"The pieces were all made in different times and about different topics but they all have something in common and that is the leadership and matriarchal worldview that is being celebrated in all three of these pieces," says Chacon.

Amidst careful orchestration, viewers are transported to a handful of key moments — some celebratory, some bloody, all staggering. From the Oceti Sakowin camp of Standing Rock NoDAPL resistance to tri-part hymnal tomes sung on and for ancestral lands, Chacon has arranged a sum larger than its parts, forming a narrative for that which is often unheard.”

Read more at www.taosnews.com

With the world’s wealthy migrating to new countries in record numbers, the global property market for high-end homes is witnessing a dynamic shift, as savvy investors look beyond their traditional borders to secure prime real estate.

In the U.S., foreign interest in residential properties sat at a 15-year low, according to a July 2024 report from the National Association of Realtors (NAR) on international transactions in U.S. residential real estate, driven in part by a strong U.S. dollar and rising home prices. NAR also estimated that 50% of U.S. home sales to foreign buyers were in cash, making the strong dollar a deterrent to international home sales. However, this trend may change in the coming months, according to NAR chief economist Lawrence Yun.

In 2025, international engagement in the U.S. could seem uncertain at first, Yun says, due to the high trade tariffs the president-elect has suggested implementing against countries including Canada, Mexico and China, which led the list of countries with the most U.S. home purchases, according to NAR. “Yet the [incoming] administration is likely to welcome foreign investment and purchases in the U.S., since the concern is about Americans buying too many foreign products [over those made in the U.S.],” Yun says, adding that, as a real estate developer with a number of properties in the U.S., the president-elect would no doubt welcome foreign buyers. “In addition, the Federal Reserve and many other central banks are in an interest-rate-cutting mode and that often lifts real estate sales, including international sales,” Yun says. “I expect some gains in foreign buyers in 2025.”

Read more at https://www.luxuryoutlook.com/2025-luxury-outlook-report/property-playbook

Heading northwest from Taos, New Mexico, the sparse, sage-filled desert soon begins to sparkle as looming, Seussian structures appear in the distance. Earthships, as these buildings are called, may look like giant earthen pottery, but they’re actually thoughtfully designed passive solar homes.

New Mexico’s futuristic Greater World Earthship Community is home to 113 Earthships. Dazzling from afar, their architecture is even more intriguing up close. Decorated with colored bottles that reflect the sun’s light, these structures jut out from the desert floor like mystical relics floating on barren hills.

Read more at…. https://www.apartmenttherapy.com/earthship-homes-taos-new-mexico-37414760

“Water leaking from the roof, rotten wood, and broken circuits; the building was in disrepair and, they would later discover, the breaker box wasn't even grounded.

For one of the most important art and cultural centers in Taos, and one of the few on Taos Pueblo tribal grounds, the Oo-Oo-Nah Art & Cultural Center was in dire straits. With no government or tribal funding, the center relies completely on grant, donation and fundraised money.

But then an 8x10 painting by Mark Maggiori lent an $80,000 dollar helping hand.

The story starts further back, as Lyle Wright, a board member of Oo-Oo-Nah, often poses for Mark Maggiori, a French painter skilled in dreamy, photorealistic captures of the southwestern spirit. With board approval, Wright and Maggiori decided to create a painting for auction, with proceeds going directly to the center.

As the yellow aspens were already spent, they organized a shoot near the gorge. Ashley Rolshoven from Parsons Gallery of the West provided the horses and Chris Ferguson from Tres Estrellas Design fashioned the model's blankets and serapes.”

Read more at www.taosnews.com

In Brooklyn, neighbors are building their own power grid. They are not only producing their own energy, but they also want to start trading it amongst themselves.

For Taos Woman magazine I profiled three Taoseña nominees, Contessa Trujilo, Shannon Lujan and Letricia Ortega, along with writing a feature story on Rolling Still distillery ounders titled “Distling those high desert dreams: A testament to women, vodka & whiskey.”

From Contessa Trujillo profile:

“2024 Taoseña nominee Contessa Trujillo is a true steward of cultural preservation and sustainable tourism in Taos. With over two decades experience in arts and community engagement, Trujillo serves as Community Engagement Facilitator for the Destination Stewardship Plan and has been The Paseo Project’s Programs and Operations Manager since 2022.

With love for both tradition and innovation, she’s a gifted intermediary connecting the spaces between ancestral lineage and modern livelihood. “In some facet, I've always worked within the community, arts, and non-profit worlds, which have intersected in a whole variety of ways.

Raised by a creative family, Trujillo enjoyed a rich upbringing inspired by visual arts and music. Her mother worked as a beautician and Trujillo recalls the inspiration she felt in her mother’s salon, Spirits of Beauty. “She worked with a lot of prominent figures and interesting Taos characters, particularly people in the arts, so I had this great fortune of being exposed to these spaces and people,” says Trujillo.”

Read more at www.taosnews.com

“Women owned and family run,” is the motto Rolling Still owner’s Liza Barrett and Nicole Barady use when describing their iconic Taos distillery. Their business partners, husbands Dan Irion and Scott Barady, work as distillers while Liza and Nicole run the show. Having lived in Taos nearly 20 years, Barrett and Barady, from Texas and Wisconsin respectively, had no idea they’d eventually produce some of Taos’s most favored spirits.

“The origin came long before that when we all became close friends,” remembers Barady.

Working in the ski valley together — bartending, then as gardeners, caterers, and eventually in a women’s circus troupe called the Flying Desert Brigade — their trust in one another grew deep. With children born three weeks apart, they grew even more tight-knit.

Little did they know they would soon trade stilt walking, trapeze and acrobatics for corn, mash and high mountain spring waters, transitioning into something completely new for both themselves and Taos.”

Read more at www.taosnews.com

“Gathering at the plaza on winter’s solstice eve, Taoseños of all walks will join to honor those in the community who have died while homeless. The Longest Night event unifies the sheltered and unsheltered through memorial and advocacy, beginning with a candlelit vigil and short lineup of speakers followed by a free hot meal allowing the community to break bread together.”

Read more in Taos Aglow

One out of every five New York City commercial spaces currently sit empty. Post-pandemic vacancies have reshaped Manhattan and this country as we know it.

The rental forecast for commercial spaces remains grim as city officials warn Manhattan’s abnormally high vacancy rate should persist well into 2026. As of August 2023, Manhattan is currently at 22.7% office vacancy with little hope of recovery anytime soon.

New York City commercial vacancy rates typically hover at a steady 11%, but as the pandemic continued into the early 2020s, those rates climbed to 15% and beyond. Currently, the national average for 2023’s first quarter is 18.6%, with cities like Denver and Seattle squarely at 20% vacant.

For many, these vacancies hit close to home- shuttered bodegas, struggling independent shops, and the loss of retail storefronts continues to alter the dynamic of neighborhoods throughout the city. Look closer, and empty offices bleed into transport as well; rush hour subways are only half full, a far departure from an overcrowded past.

Lower and midtown Manhattan and downtown Brooklyn have seen the highest turnover and climb in vacancy rate changes to speak of. Despite receiving the most COVID-19 grant and loan money, businesses and offices continue to empty out.

Manhattan’s Troubled Rental Landscape

Spikes in vacancy affect not only landlords and building owners but the city as well. One of New York’s most important revenue sources is property taxes. Nearly 20% of New York City’s total tax revenue comes from commercial property taxes, with 10% attributed straight to office building rentals. In the first quarter of 2023, 4.6 million square feet were leased in the city, while asking rents for offices in NYC were priced at $78.35 per square foot. In April 2023, the price was at an average of $75.13 per square foot, down 50 cents in a YoY comparison, according to a Colliers market report.

OFFICIALS ESTIMATE THAT OVER HALF OF MANHATTAN’S 450 MILLION SQUARE FEET OF OFFICE INVENTORY IS PRACTICALLY OBSOLETE.

Manhattan isn’t an easy place to open a business. Especially for family-owned shops, the regulatory hoops, and hurdles of rising rent, taxes, and industry competition challenge even the most genuine intentions. Inflation has taken its toll and led to genuine change across the city landscape. Take a walk down Third Avenue in midtown and you can see for yourself. Empty storefronts and boarded windows have sucked the magic out of New York’s once-energizing presence.

How Much NYC Office Space Is Actually Being Used? How Much Is Under Construction?

A major contributing factor to vacancies is the underperformance of aged commercial spaces. The shift into remote working left many businesses reconsidering their needs and desires for office space. Pandemic downtime made room for major remodels and full or partial fit-outs as companies dreamed of an eventual return to normalcy. The demand for older buildings- many with poor energy performance and outdated design- began to plummet, leaving skyscrapers and roadside shops alike empty around the city.

A sustainable apartment in New York City would be unheard of ten years ago. LEED certifications and Passive Houses that use a tenth of the energy of a regular house seem out of place in a city that spares at no expense. That may be beginning to change.

Buildings are responsible for two-thirds of New York’s greenhouse gas emissions, pushing officials to scramble for sustainable solutions. Recent laws passed to curb emissions have created momentum for building green, and a looming 2024 retrofitting deadline has builders adjusting their plans to comply.

Sustainability has become a popular topic, even in New York. At nearly sea level, in a region prone to hurricanes and storms, New York is more fragile than it would like to admit. Mayor Bill de Blasio, called the Climate Disaster Mayor, has enacted a number of laws to combat climate change, including the Climate Mobilization Act of 2019. While passing the act, De Blasio pledged to make New York City a carbon-neutral city by 2050 while reducing greenhouse gas emissions by 80%. Sustainable building is the path to this reality.

Is NYC a Sustainable City?

Sustainable Building As The End Goal

Compared to the rest of the United States, New York is not doing poorly. With less greenhouse gasses per capita than any other city, New York is one of the most energy-efficient places in America. New Yorkers travel mostly by foot or mass transit, leading to a minimal transportation footprint, while in the United States, the majority of greenhouse gasses come from transportation, mainly single-passenger vehicles. Even so, any gains made through mass transit are quickly lost through the high-energy use of buildings.

Multifamily and office buildings use 87% of the energy benchmarked for buildings. Half is in the form of electricity, with space heating, mostly by natural gas, as the largest end use. The US would save $20 billion in energy costs through green-improved buildings. Environmentally friendly design techniques, eco-friendly materials, and advanced technologies all save on both energy and money.

Among the laws passed within the Climate Mobilization Act is Local Law 97. This law requires buildings over 25,000 square feet to meet new energy efficiency and greenhouse gas emission requirements by 2024, followed by another set of more stringent requirements in 2030. Buildings that fail to comply will be issued steep fines.

Some folks were already prepared. A number of realtors and developers went green long ago. With “passive house” and LEED certification becoming selling points for the wealthy- this is likely a growing trend.

America's infrastructure is in a state of crisis. Roads and train lines are old, dangerous and cost the country billions of dollars in economic growth. Trump wants to repair damages but he is at the mercy of investors.

The summer of hell began for New Yorkers last Monday. Beginning at four o'clock in the afternoon people hurried home from work, clogging midtown Manhattan's Pennsylvania Station. Over 600,000 people trek to Manhattan daily from faraway places like New Jersey and Long Island, entering the city via Penn Station. More people transit through Penn Station than all three of New York's airports: JFK, LaGuardia and Newark. Yet on Monday many tracks were shut down for the summer so the city can begin tackling urgently needed repairs.

"We are now beginning to see what happens when mass transit systems break down. We have a painful precursor, a series of breakdowns with Amtrak and Pennsylvania Station," said New York state Governor Andrew Cuomo, "When you close down the tracks there is a series of dominoes that fall, that puts the entire system near collapse." This was during the press conference where Cuomo declared a state of emergency for the transit system.

The old subways of New York

And it is not only the subway that needs repair: Streets are littered with potholes, dilapidated tunnels are increasingly dangerous and the sewage systems need maintenance. Electricity grids, gas and oil pipelines, ports, freight rail and internet broadband are all infrastructure that require constant maintenance, yet they are privately owned and well kept.

It is the infrastructure that falls under government watch that is failing. "Everyone wants the benefits of good infrastructure and nobody wants to pay, so things are allowed to deteriorate," says Ingo Walter, Professor Emeritus of Finance at New York University, "Transportation is the lynchpin. Fixing our roads, bridges, tunnels and transportation hubs are a must and will have the biggest impact."

Every four years the American Society of Civil Engineers (ASCE) measures the conditions of bridge, water and transportation infrastructure within the US and publishes its findings through the Infrastructure Report Card. New York received a C- in 2017. With one-third of America's entire public transport belonging to the state of New York, this is a critical and costly failure.

The report card for America's entire infrastructure system was even worse. The US scored a lowly D+.

From painter to designer to typographer to sculptor to documentarian, Olga Brava is a master manifestor. Embarking on numerous artistic voyages throughout her life, her visionary take on the world makes even the loftiest dreamers want to dream deeper. Since arriving in Taos, Brava has segued into a few unlikely but fitting paths — homebuilder, architect and now firekeeper.

Brava spent the beginning of her life on the East Coast between Boston and New York City. It was there that she emerged as a painter, showing in downtown New York galleries by the age of 19. Eventually, a hunger for more propelled her into a completely different field: ceramics. Now, 25 years into that love affair, she is still digging deep into the medium.

“The minute I found clay it was a done deal. I felt this connection. You have these moments sometimes when you find something and you’re like ‘Wow, I feel as if I was doing this in a past life,’” asid Brava. “You can’t explain it. I could do this for the rest of my life and I wouldn’t even scratch the surface, there’s so much there. So I got out of design and never looked back.”

Even so, one can see how design and typography continue to inform her stylistically, blossoming within details. Her precise, articulate forms and etchings hint at ethereal underpinnings. Toying with symmetry and playing with shape, her sculptures, some abstract and others figurative, call to our deepest associations and alliterations. Brava gracefully meanders the fine line between literal and figurative, conscious and subconscious, known and unknown, bringing the viewer along for the ride.

Photos by Kyle Knyazev-Julinski

“New chefs, new dishes, new season … it all in the 2024 Winter/Spring Dining Out Guide in this week's Taos News.

The new Dining Out guide provides insight into the best restaurants in Taos and Northern New Mexico. From Mexican to Asian, and everything in between, the Taos Dining Out has something for everyone's palate.

Whether you are planning your visit or are a lifelong Taoseño, don't step out to eat without picking up your copy in this week's edition!”

Read more at https://www.taosnews.com/look-for-it---dining-out-winter-spring-2024/article_667f17a2-92d3-11ee-8c58-eb05867bae39.html

Gaining popularity while touring the film festival circuit, music documentary Texas Music Revolution by Taos filmmaker Troy Paff received a welcome reception at New Mexico's 15th Annual Santa Fe International Film Festival. Following successful showings at the Catalina Film Festival and Woodstock Film Festival, this feature length documentary has been on the rise since its premiere, and it's not hard to see why.

The trailer opens with the voice of Kiefer Sutherland: "Country music is storytelling. You get a sense of where people are coming from and where their families have been; country music specifically is American storytelling."

Following KHYI 95.3 FM’s general manager Joshua Jones as he navigates the Dallas-based independent radio station through the throes of producing its 25th annual Texas Music Revolution music festival, viewers get a behind-the-scenes seat to a variety of challenges and their payoffs; from tracking down a long lost musician to a famous movie stars' foray from film to country music.

"The movie is very much a celebration of Texas roots music, which is a purist form of country. It does honestly express one of the three pillars of country music. You've got the Nashville sound, you've got the Bakersfield sound, and then there's the Texas sound," said director Troy Paff. "Which tends to be outlaw country, Waylon and Willie kind of stuff. That has a direct overlap into Taos.”

With interviews and cameos by Kiefer Sutherland, Charley Crockett, Ray Wylie Hubbard and Joshua Ray Walker, this film is everything you'd want in a Texas music documentary including high stakes and high drama.

Photos courtesy of Troy Paff

His professional and artistic work is scattered throughout Taos and Santa Fe; from sculptures and installations to carefully hand lettering the headstones of notables like Frank Waters, Mark Saxe's craft is permanently etched into the New Mexican landscape.

Dixon sculptor Mark Saxe was recently awarded the prestigious Governor's Award for the Excellence in the Arts. One of eight recipients, this lifetime achievement award brings well-earned acknowledgement to 48 years of hard work with an even harder-headed teacher: stone.

"I had shapes in my head that I needed to get out," reflected Saxe on his artistic career. "When I go on hikes, I see these incredible formations and think, 'Oh, God did it already.' I try to capture that just like a poet would try to capture a moment. I try to capture the essence of that which I think is extremely beautiful and powerful. Sometimes it's a landscape, sometimes it's a person's face."

In many ways, a lifelong relationship with stone seems a natural progression for Saxe. The paradoxical interplay between permanence and impermanence has remained thematically entrenched in Saxe's life and life's work. Even his last name, Saxe, is foreshadowing; Sax being the Latin word for stone. Saxe has artworks in private collections across the world. Working with various types of stone, some weighing up to 13 tons, a single project can take months to complete.

Photos by Lindsey Rae Gjording

Each fall, it happens. Seemingly overnight the roads and highways surrounding Taos and Tres Piedras grow mottled with the slow crawl of tarantulas. While this arachnidian phenomenon appears straight out of a Halloween flick, or might be confused with a mass migration, in actuality these spiders are out looking for a mate.

"It's not a migration, like it’s referred to,” said Chris Hamilton, an arachnologist at the University of Idaho. “It’s mating season, and they exhibit a type of mating behavior called 'scramble competition,' where a lot of males come out at one time and 'scramble' or all try to get to the available adult female tarantulas to mate with them before any other male gets to her.”

According to Live Science, tarantulas spend the majority of their lives safe and hidden from harm in underground burrows. Invisible neighbors for much of the year, they flock en masse come late September and early October. Scientists are still not entirely sure what triggers the exact timing of their movement.

While tarantulas aren’t likely to wander through downtown Taos, locals and visitors don’t have to venture far to admire their slow swagger. The Rio Grande Gorge Bridge, West Rim Road and Tres Piedras are high-traffic areas for several species of tarantula common to the high Southwestern desert.

Photographs by Lindsey Rae Gjording

Taos Cow recently opened its long-awaited second location in the Cañon neighborhood's Anglada building, providing a familiar al fresco-style dining experience in a historic courtyard.

Following a celebratory soft opening over the weekend that brought locals out in force, Taos Cow staff were again busy serving piping-hot green chile Reuben's and waffle cones packed with flavor favorites like Mexican Chocolate and Piñon Caramel on Monday (Oct. 16).

"I was really happy to see how many people have been walking to Taos Cow, which means its people from the neighborhood. I hope that keeps up," founder and owner Jamie Leeson said. "I love serving the Cañon area."

Located in the historic Anglada building, the second Taos Cow location is a walk-up shop with ice cream, coffee and sandwiches, while further down the building, a commercial kitchen is used to prep food items for both locations. Adjacent to the walk-up window is a wide-open courtyard with a stage.

"We've kept both facilities with exactly the same menu, exactly the same formula," said General Manager Curly O'Connor. "We're not going to change. What's working now is working great."

Photos by Alexandra Cancro

Studies suggest more than half of all US convicts will reoffend as it can be tough to avoid the downward spiral after incarceration. But inspiration can be found at a gym in the heart of midtown Manhattan in New York…

With feet propped up on a toilet for added height, Coss Marte exercised daily, doing push ups until he could barely lift his arms. Then he would brace his hands and feet against the walls of his cell, pushing into a plank position. His home was a 9-by-6 foot (2.7 by 1.8 meter) cell that forced him to be creative with space.

Coss pushed forward day by day and tweaked his workout routine until it satisfied him. He dropped 70 pounds (31 kilos) in six months and other prisoners began to take notice. Soon Marte was leading over 20 inmates through daily exercise routines in the yard. The group lost a collective total of 1,000 pounds (454 kilos).

This is the story of how Coss Marte, an entrepreneur and innovative hustler, turned lemons into lemonade while serving time for leading a $2 million dollar (1.76 million euro) cocaine operation. Now, less than five years later, he is a free man and the CEO of ConBody, a gym that specializes in "prison-style bootcamp”.

In a poetic turn of events, Marte opened his first gym in 2014 on the same corner that he used to deal drugs from. From there the popularity of his unique style began to snowball, until he was approached about opening a gym in Sak's 5th Avenue, the heart of midtown New York and the land of rich young professionals.

313 East 6th Street, listed by Glenn Schiller and Tifany Gangaram of the Corcoran Group, went up for sale after over half a century and is now currently in contract as of June 26th, 2023. Formerly the residence of famed painter Mark Rothko and notable creators Alfred Leslie and Emile de Antonio, this building once ran a social club in the basement. Come take a look!

The pre-war multi-family townhouse located at 313 East 6th Street has been listed for the first time since the 1970s. While all New York buildings have their stories to tell, this one has seen more than most. Home to multiple famous artists and a documentary director, 313 East 6th Street has survived both raging fire and FBI surveillance units. It now awaits its next chapter and next owners.

East Village Greek Revival Mansions

Originally constructed in 1853, later renovations reformatted the single-family home into three apartments. In 1902 the residence was officially relabeled a multi-unit dwelling.

The entryway features an original double-wide formal entrance and brownstone stoop. The house contains traditional Greek Revival elements with complimentary Italianate details, similar to other houses on that street. Brick interior walls, tall windows, and original staircases add authentic charm.

A large 30-foot backyard offers a green respite for sun and lounging while high ceilings deliver both northern and southern light to the bedrooms. The home has 6 bedrooms and 6 bathrooms with a total square footage of 5,480 square feet.

Any one of these eleven thoughtful gift ideas are practically guaranteed to up the color, heat, and flavor in your loved one’s kitchen—and hopefully, your belly.

It’s the most wonderful time of the year! You don’t get to shower your loved ones with tokens of your appreciation every day—it’s time to track down the perfect gifts for your favorite people, including all the chefs in your life.

Gifting to a kitchen connoisseur can be difficult—do they already own this? Will they like it? And most importantly... will they use it? It's easy to get lost in aisles of sparkly kitchen gadgets and limited edition culinary tools. That’s why we went ahead and did the hard work for you. This list of extra special kitchen essentials and favorites will bring a smile to anyone's face and add joy to any meal. The following list comes from the OA team’s own kitchens—each of these tried and true essentials will up the color, heat, and flavor in your loved one’s cooking.